英国医疗服务PPP:Derant Valley医院案例分析(中英文对照)

Li C., Mern A.等 PPP知乎

摘自欧亚PPP联络网编著,王守清主译.《欧亚基础设施建设公私合作(PPP):案例分析》(中英文对照),第230-247页,北方联合出版传媒集团,2010年8月

PPP知乎,您的PPP大百科!

~~~~~~~~~~~~~~~~~~~

Case Study - Derant Valley Hospital UK PPP for Health Care Provision / 案例 – 英国医疗服务PPP:Derant Valley医院

by Ce Li, edited by Dr. A.Merna and Mr. D. K. Anderson, University of Manchester

曼彻斯特大学Ce Li;A. Mern 博士和D.K. Anderson 编辑;清华大学赵国富和王守清译

1.1 Introduction / 引言

This case study describes the processes,risks and financial aspects associated with the first PPP hospital built in the United Kingdom.Since this hospital’s inception over 34 more hospitals and 19 other health schemes have been procured under PFI in the United Kingdom, many of these hospitals have followed this model although some have used the private sectoras well as the public sector to provide health care.

The Derant Valley Hospitalis a state of the art hospital built to a maximum three storey building heightand catering for a variety of medical conditions and the necessary facilities and treatment.

本案例介绍了英国建设的第一个医院PPP项目的过程、风险和财务方面的信息。自该医院兴建以来,英国已有超过34个医院和其它19个医疗计划是采用PFI模式获得的,尽管有一些医院已由私营部门和公共部门共同来提供医疗服务,其中许多医院仍然沿用这一模式。

Derant Valley医院是一所现代化的医院,共三层,具备各种医疗条件、配备必要的设施并提供必要的医疗服务。

1.2 Project History / 项目历史

Derant Valley Hospital project was the UK's flagship PFI hospital development. The overall planning and development allowedfor change and growth throughout the hospital. With the number of older people increasing, there are more than 200,000 patients needing to be cared for every year in Dartford. The three old and outdated hospitals, Joyce Green, West Hill and Gravesend and North Kent in Gravesend, could not meet the required demand or service necessary.

Derant Valley医院项目是英国PFI医院发展的标志性项目。整体计划和发展要求医院进行变化和发展。随着老年人的不断增加,在达塔福德(Dartford)每年有近200000病人需要护理。格雷夫斯(Gravesend)的三个陈旧和过时医院——JoyceGreen、West Hill and Gravesend和North Kent,已经不能满足需求或提供必要的服务。

In1995, Dartford & Gravesend NHS Trust (DGNHST) considered providing a new,advanced hospital to replace the old ones in order to provide a better healthcare service. A feasibility study was undertaken in 1995 by DGNHST, which clearly indicated that the PFI/PPP route was a realistic one. It should benoted that this project would not have been sanctioned if a PFI/PPP procurement strategy had not been adopted. It was in fact the only deal in town. The project was advertised in the Official Journal of the European Community (OJEC) later that year.

1995年,达塔福德和格雷夫斯国家卫生部信托基金会(DGNHST)考虑兴建一座新的、先进的医院来取代旧的医院以提供更好的医疗服务。该基金会于1995年进行了可行性研究,明确指出PFI/PPP模式是一个现实的方案。需要注意的是,如果没有采用PFI/PPP采购策略,该项目可能不会获得批准。事实上,该项目是该城镇唯一的PFI/PPP项目。该项目同年晚些时候在欧盟官方杂志(OJEC)上发布了公告。

Abid procedure typically has three routes:

§ open procedure

§ restricted procedure

§ negotiation procedure

招标程序通常有三种方式:

§ 公开招标

§ 限制性招标

§ 协议招标

However, the open procedure isnot suitable for PFI projects, as the cost of bidding is too high to encouragea large number of competitive bidders and a negotiated contract was notconsidered to comply with UK and EU requirements. DGNHST therefore employed a restricted procedure wherebidders expressed an interest with some invited to pre-qualify. A thorough andclear specification set out the criteria that bidders had to follow. The philosophy behind the bid was to give healthcare staff the best environment that would allow them to spend more time on patient care. After six months assessment and approval by the Department of Health, of the full business case prepared by the Trust, there emerged a preferred submission, that being The Hospital Company (Dareath Ltd.) that is a consortium made up from Carillion Construction and Carilllon Services.

然而,公开招标方式不适用于PFI项目,因为投标费用非常高以至于不能吸引大量投标人;协议招标也不适用,因为与英国和欧盟的要求不符。因此,基金会采用了限制性招标方式,邀请有兴趣的部分投标人参与资格预审。全面和清晰的说明书明确了投标人所必须遵照的标准。最基本的要求就是为医护人员提供最佳的环境以利于他们用更多的时间用来照顾病人。卫生部对基金会编制的整个商务方案进行了六个月的评估和批准,由科瑞林(Carillion)建设公司和科瑞林服务公司组成的联营体德莱斯有限公司(Dareath Ltd.)脱颖而出成为首选中标者。

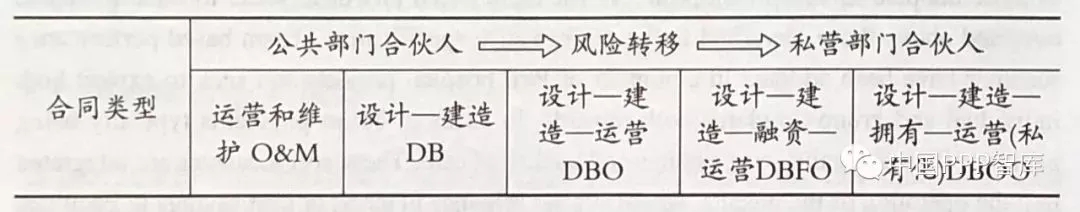

DareathLtd. was awarded a contract to design, build, finance and operate (DBFO) a new 400 bed hospital at Derant Park to replace the threeold and outdated hospitals. Carillion Construction Company had responsibilityfor the design and construction of the new hospital. The subsequent provisionof support service is provided by Carillion Service Ltd. and its subcontractors.DGNHST leases the hospital building, purchases ancillary services, such as catering,cleaning and security from Dareath Ltd. The NHS, however, employs medical and para-medical staff drawn from the public sector who work alongside the Facilities Management company drawn from the private sector.

德莱斯有限公司获得了在Derant公园设计、建造、融资和运营(DBFO)一个含400个床位的新医院以取代三个过时旧医院的合同。科瑞林建设公司负责该新医院的设计和建设,而科瑞林服务公司及其分包商负责提供相应的服务支持。项目建成后,基金会(DGNHST)向德莱斯有限公司租用医院建筑,购买配套服务,如餐饮、保洁和保安服务。而国家卫生部(NHS)从公共部门抽调聘用医生和辅助医务人员与来自私营机构的设施管理公司一起工作。

Opened in September 2000, Darent Valley Hospital has 419 beds and provides in-patient and out-patient care, drawing on an annual budget of around ?80 million starting in 2001. (K&M 2004). The hospital employs more than 1500 medical and non-medical staff and has contract term of 28 years of operation and maintenance. Financial difficulties in terms of meeting repayments have necessitated the Trust negotiating to extend the service contract for a further 5 years.

DarentValley医院于2000年9月开业,共有419个床位,可为住院病人和非住院病人提供医疗护理,从2001年起,每年的预算约8千万英镑(K&M2004)。该医院雇佣了1500名医生和辅助医务人员,签订了28年的运营和服务合同。还本付息的财务困难使该基金会需要进行延长5年服务合同的谈判。

1.3 Project Objectives / 项目的目标

The main objectives of this project were to create a state of the art medical facility which would provide value for money and provide much needed treatment to the public in the North Kent area. If successful, the PPP arrangement would then form a model for future hospital projects.

该项目的主要目标是建设一个现代化的医疗设施,实现物有所值,为北肯特地区的公众提供所需的医疗服务。如果成功,PPP模式将会成为未来医院项目的典范。

A further objective was to ensure that the stakeholders to the project, both internal and external were all involved in the decision making process as the project developed.

进一步的目标就是确保项目的干系人,包括内部和外部的,都能随着项目的发展参与项目的决策过程。

As a flagship project both the public and private sector partners were keen to ensure a successful project based on a carefully researched performance specification based on extensive consultation with all stakeholders.

作为标志性的项目,公共部门和私营部门参与方均渴望利用在广泛咨询所有干系人基础上仔细研究确定的绩效标准来保证项目成功。

1.4 Project Partners / 项目参与方

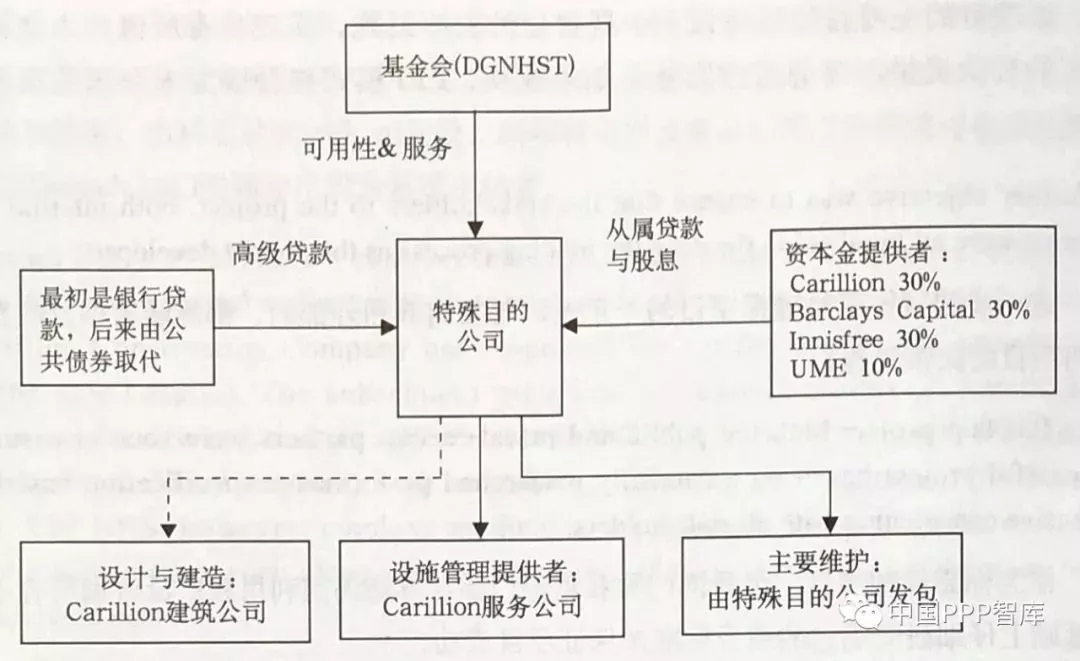

Figure1 illustrates the project structure and the financial flow for the project.

图1表示了该项目的结构和资金流。

Figure 1: Project structureand Financial Flow, (Carillion 2004)

图1:项目结构和资金流

Project stakeholders’ interest can be positively or negatively affected by any project. In recent years,public dissatisfaction with public hospital projects applying a conventional approach to health care has increased. Stakeholder groups felt left out and the hospital Trust were under-informed. Hospital staff that were directly affected were not involved or were only involved to a limited extent and often late in the project. The lack of stakeholders’ involvement tends to generate a situation where those groups involved in the project under-perform. Under this PPP arrangement both public and private sector stakeholders were encouraged to actively involve themselves from the start of the project. "Satisfy Stakeholders!" is Derant Valley Hospital project's mantra, an objective that has been met.

项目干系人的利益可受到来自任何项目的正面或负面影响。近几年,公众对应用传统方式提供的公共医院项目越来越不满。干系人感觉自己被忽略了,医院基金会没有获得足够的信息。受影响的医院员工没有参与或只是有限或滞后参与项目。干系人参与的缺乏导致参与项目的这些团体表现不佳。而在此PPP模式下,公共部门和私营部门都获鼓励,从项目开始就积极参与项目。“使干系人满意!”是DerantValley医院项目的口号,也是已实现的目标。

To succeed, it is not enough to deliver on the Trust's demand, it is also critical to understand who the potential project stakeholders are and the potential roles that they will play in the development of the project, and meet all stakeholder expectations.Identifying stakeholders was a primary task because all the important decisions during the initiation, planning and execution stages of the project were made by these stakeholders. Under the Derant Valley Hospital project, stakeholders were not only those in the project team, the functional management, the sponsor, and hospital staff, but also include anyone who is impacted by its results. Table 1 illustrates the internal and external stakeholders to this project.

为了取得成功,仅仅满足该基金会的要求是不够的,同样关键的是要了解谁是潜在的项目干系人和他们在项目发展过程中所扮演的角色,以及满足所有干系人的期望。识别干系人是第一步工作,因为在项目启动、规划和实施阶段所有重要的决定都是由这些干系人做出的。在DerantValley医院项目中,干系人不仅仅是项目团队中的人(如职能管理、主办人、医院员工),还包括任何受到项目结果影响的人。表1列出了该项目的内部和外部干系人。

1.5 Project Scope / 项目范围

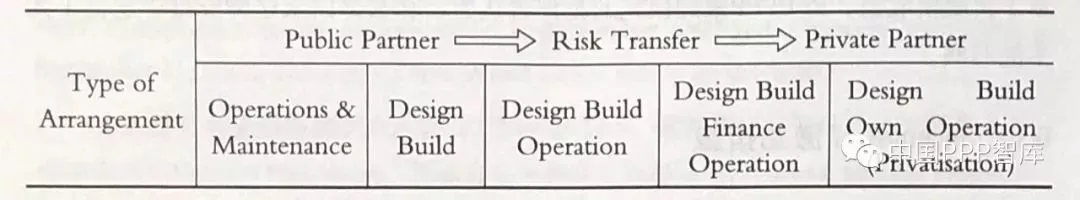

The project is located in the Dartford and Gravesend area of North Kent in the south east of England and was designed to accommodate those services previously provided by 3 old hospitals. The new hospital provides numerous medical care facilities for both in and out patients. The hospital is financed, built and operated by the private sector with health care provided by the public sector. At the end of the operation and maintenance term contract the facility will be transferred to the public sector who will have the opportunity to either manage the asset themselves or offer through a competitive tender a further Facilities Management contract for a specified time period.

该项目位于英格兰东南部NorthKent的Dartford和Gravesend地区,目的是提供原先由三个旧医院提供的医疗服务。新医院提供多种住院和非住院医疗服务。项目的融资、建造和运营由私营部门负责,而医疗服务则由公共部门负责。在运营和维护合同期届满时项目设施将移交给公共部门,后者有权决定自己管理该资产,或通过竞争性招标发包一定期限的设施管理合同。

1.6 Legislation Issues / 法律事项

Nospecial local, regional or national enabling or statutory legislation was needed as PFI/PPP projects have been an integral and major part of infrastructure development, operation and maintenance in the UK for over twenty years. Both alegislative framework and a growing case law history were in place.

不需要任何特殊的地方、区域或国家层面的法规立法,因为PFI/PPP项目在英国成为公共基础设施发展、运营和维护的重要组成部分,已有20多年的历史,已经有了相应的法律框架和不断增加的判例记录。

1.7 Concession Agreements / 特许权协议

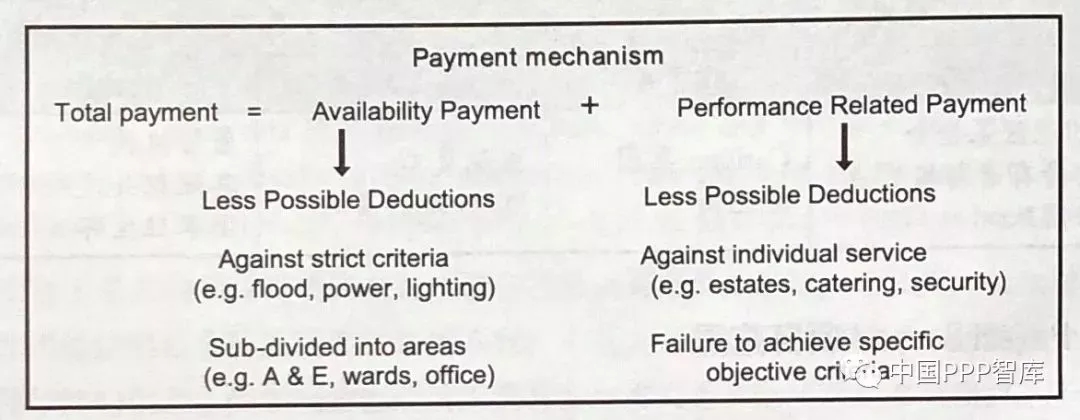

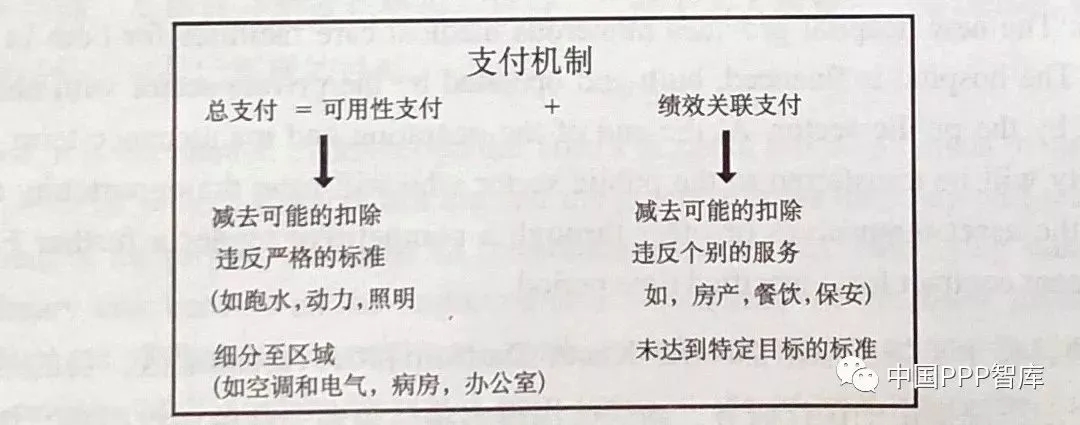

Figure2 illustrates the payment mechanism for this project.

图2说明了该项目的支付机制。

Figure 2: Payment Mechanism

图2:支付机制

The delivery performance of the service proposed is linked with the payment mechanism, which can provide value for money for the public. In this payment mechanism, the total payment comprises an availability payment and a performance related payment. Certain quality criteria were established and if the operator fails to achieve the specific objective criteria, there will be a reduction in the performance related payment.

既定服务提供的绩效与支付机制相关联,可为公众提供资金的价值(物有所值)。在该支付机制中,总支付由可用性支付和与绩效关联的支付组成。制定了一定的质量标准,如果运营商未能达到相应的标准,与绩效关联的支付将被扣减。

1.8 Financial Arrangements / 融资安排

1.8.1 Initial Arrangements / 初始安排

The total financing requirement for the project was ?115 million. The financial instruments employed in the project were debt and equity at Financial Closure, followed by a debt/bond swap and sale of equity as part of the project refinancing.

该项目总投资1亿1千5百万英镑,融资完成时本项目采用的融资工具是贷款和资本金,此后则有债/券转换和资本金出售作为再融资的一部分。

The SPV initially borrowed the majority of the money needed for the project with the total funding requirement of the project provided in a ratio of approximately 88:12 of non-recourse debtto equity (?101 million long term debt and ?14 million equity).

特殊目的公司(即项目公司)最初借贷了项目所需总资金的绝大部分,其中无追索贷款和资本金的比例约为88:12(即1.01亿英镑的长期贷款和0.14亿的资本金)。

Funding for the Derant Valley hospital project was obtained in the form of long-term bank loans (some of which were replaced by bonds during the operation period) without recourse to the shareholders and were secured on the assets of the SPV. The lender recognised the risk of the SPV defaulting on its loans and thus required shareholders in the SPV to place some of the capital at risk as an incentive to perform in the form of equity. ?14 million equity was issued in a subscription of shares, which was a loan from the shareholders of the SPV. Equity investment carries a higher risk than non-recourse debt as it pays out a return only afterall other liabilities of the SPV have been discharged in full.

Derant Valley医院项目的资金主要通过银行长期贷款的方式获得(其中部分在运营阶段被债券所替换),且对项目股东无追索,仅以项目公司的资产作担保。随后放贷方认识到项目公司不能还本付息的风险,于是要求项目公司股东以资本金的形式投入部分承担风险的资金作为一种激励措施。发行了0.14亿英镑的资本金作为配股,是项目公司股东的出借款。资本金投资比无追索贷款承担更高的风险,因为只有当项目公司所有的负债都还清之后,股东才能获得回报。

The principal bank advising the Trust was Lloyds TSB, the financial adviser was KPMG and the legal adviser was Nabarro Nathanson. Debt was raised from Deutsche Morgan Grenfell, UBK Rabobank and 11 other banks. Financial Closure for this project was 30th July 1997.Construction on the project started in September 1997 and it became operationalon 11th September 2000. The 3 year construction period was to programme.

为该基金会提供咨询的首席银行是Lloyds TSB,融资顾问是毕马威会计师事务所,法律顾问为Nabarro Nathanson。贷款来自于德意志摩根建富(DeutscheMorgan Grenfell)、UBK Rabobank 和11家其他银行。该项目的融资完成时间为1997年7月30日,项目建设于1997年9月开始,于2000年9月11日投入运营,三年建设期符合计划。

1.9 Refinancing / 再融资

In 2001, the SPV of the Derant Valley Hospital project, which was ?101 million in debt, refinanced part of the debt by swapping ?8 million of senior debt into a bond. This resulted in a reduction in debt payment allowing the SPV to better manage its debt and improve cash flow. The fixed coupon bondwould only pay bi-annual coupons over a period of 10 years but would not payany principal until the end of that period.

2001年,Derant Valley医院项目的特殊目的公司(负债1.01亿英镑),通过将800万英镑的高级债务转换为债券进行了再融资。这样减少了还债负担,从而使项目公司能更好地管理债务和改善现金流。固定息票债券只需在10年期内每年付息两次,而不必在该期间偿还本金。

In November 2003, the SPV sold ?4.1 million equity in the Derant Valley Hospital PPP concession to Barclays UKInfrastructure Fund. In addition to the ?5.2 million that the SPV received forits equity interest, the sale crystallised as profit the ?11.2 million of cash received when this PPP concession was refinanced in March 2003. The promoter’s proceeds from the sale and refinancing are therefore some ?16.4 million, fourtimes the value of the original investment in this project of ?4.1 million. In accordance with HM Treasury Guidelines, the refinancing gain was shared with the Dartford and Gravesham NHS Trust, which received some ?10 million mainly in the form of lower annual payments to the SPV. Even though the refinancing gain was shared with the public partnercritics of the PFI/PPP procurement route consider the private sector is making too much profit from such arrangements.

2003年11月,项目公司将Derant Valley医院PPP特许权中的410万英镑的资本金出售给英国巴克莱基础设施基金公司。除了项目公司获得资本金收益520万英镑外,该项出售在2003年3月的PPP特许权再融资时沉淀为0.112亿英镑的现金利润。因此,主办人通过出售权益和再融资共获得0.164亿英镑的进项,是项目最初投资额0.041亿英镑的4倍。根据英国财政部的指南,再融资的收益应该与该基金会分享,后者获得约1千万英镑,主要以减少给项目公司的年度支付额的形式。尽管再融资收益与公共部门分享了,PFI/PPP采购模式的批评者认为,私营部门从这种安排中获得了太多的利润。

1.10 Incentives / 激励措施

Incentives,as discussed in Section 7 above are primarily team based incentives, similar to those adopted in PFI prison projects. The team based approach seeks to raise standards over and above those identified in the performance specification.Team based performance schemes have been adopted in a number of PPP hospital projects and seek to exploit both individual and group standards with rewards,in terms of bonus payments typically being paid for efficiency gains, cost savings and quality of care. These soft measures are integrated into theoperation of the hospital where similar schemes in terms of cost savings in Facilities Management are monitored by independent assessors.

正如前面第7节所讨论的,激励措施主要是基于团队的激励,类似于那些采用PFI的监狱项目。基于团队的方法力图提高标准以达到并超过绩效规范中的标准。基于团队绩效方案已在一些PPP医院项目中采用,并力图建立个人和团体标准和相应的回报,典型的回报形式有基于效率提高、成本节约和服务质量的的奖励报酬。这些软措施融合于医院的运营之中,设施管理中采取的节约成本的类似方式是由独立的评审员监控的。

1.11 Discussion / 讨论

Risk Analysis:

The risks associated with concession projects are far greater than those considered under traditional forms of contract, since the revenues paid by the principle must be sufficient to pay for construction, operation and maintenance, and finance. The uncertainties such as client’s affordability, the cost of finance,the length of concession periods, the effects of commercial, political, legal and environment factors must be considered by promoter organizations. Table 2 illustrates a number of areas of risks that impacted on the Derant Valley Hospital project.

风险分析

特许权项目的相关风险要比采用传统合同方式项目的风险大,因为投资所获收益原则上必须足以支付建造、运营、维护和融资成本。项目主办人必须充分考虑项目的不确定性,如客户的支付能力、融资成本、特许期长度、商业、政治、法律和环境的影响等。表2表明了影响DerantValley医院项目的风险。

Table 2: The PPP Risk Spectrum

表2: PPP风险

Design and Construction Risks:

Time and cost overruns, environmental issues, and inherent liabilities/defects were considered as major risks in this project. Hospitals need to plan with greater regard to community service and the possibility of risks associated with demand and destructive technology.These risks impacted on the design of the project.

设计和建造风险

工期延长和成本超支、环境问题、内在的责任/缺陷被认为是该项目的主要风险。医院项目在制定计划时需充分考虑社区服务以及与需求和破损有关的风险。这些风险影响到项目的设计。

Residual Risk:

The concession contract is over a period of 32 years, of which 28 years are operation and maintenance. The SPV faces quality issues with respect to transferring facilities, with a lower quality standard, particularly equipment at the transfer stage.

剩余风险

项目的特许期超过32年,其中有28年处于运营和维护阶段。项目公司在移交项目设施时会遇到质量风险,因为在移交时项目设施尤其是设备的质量已经降低。

Revenue Risk:

Because PPP projects often combine the cost of building new facilities with the cost ofrunning them, all of which is paid for from the revenue budget (unitary charge),this means that revenue budgets must be increased to cope with the additional expenditure. In the Derant Valley Hospital project, revenues generated by the project came from the DGNHST budget. The SPV may, in the long term face a delay in payment should the demand exceed the forecast.

收益风险

因为PPP项目经常是将建造新设施与运营该设施结合在一起,而所有成本均须通过项目收益(一次性收费)来支付,因此这就意味着收益的增加必须能够应付额外的开支。在DerantValley医院项目中,项目产生的收益主要来自DGNHST的预算。因此,从长期而言,如果项目需求超过预测,项目公司可能面临收益支付的延迟。

Operational Risk:

The Health Company may face risks associated with higher operational costs such as the cost of labour, energy and consumables over the concession period. This is currently a major problem in UKNHS Trust hospitals where a large amount of the budget has been eroded by for example, the cost of heating such facilities as world energy prices have increased dramatically. The SPV also faces the risk of not providing the specified standard of services due in part to reducing human resources which will result in a reduction of payment. The Trust will not pay for poor standards of service (see Figure 2).

运营风险

运营公司可能会面临运营成本增大的风险,如运营阶段劳动力、能源和物价成本。此风险目前是英国卫生部基金会医院项目的大问题,因为大量的资金被种种原因销蚀掉了,例如世界能源价格飙升而导致供热成本增加的原因。项目公司还会面临部分因为人力资源减少而不能提供规定标准服务的风险,从而造成所获支付的减少,因为基金会不会为不合格的服务付费(见图2)。

Regulation/Legislation Risk:

A significant consideration in the U.K, for example, the change in environmental law, building regulations or health and safety legislation often emanating from the EU, may result in unanticipated increases in capital or operating cost.

法规/法律风险

在英国还需重点考虑的是诸如由欧盟发布的环保法律、建筑规范或健康和安全立法的改变等,这些可能导致预料之外到的资金或运营成本的增加。

Financial Risk:

The ability to service debt, both principal and interest is crucial to this project. Refinancing was considered prior to sanction and was implemented in the early years of operation to mitigate such risk.

融资风险

贷款(包括本金和利息)的偿还能力对本项目是非常关键的。在批准之前考虑并在运营的前期阶段实施了再融资,以减低该风险。

Secondary Market Risk:

This project could be sold to the secondary markets, such as trust funds, pension funds or equity investors seeking long term profit from a project whose revenues are contract led. The sale of such an asset, at some time during the operation period, poses a risk to the NHS since potential new owners are not those who signed the original contract.Innisfree, one of the original financiers of this project are now the second largest owner of hospitals in the UK after the State. Changes incorporate direction of such companies could present the risk of hospitals being managed on the basis of market forces and not health care.

二级市场风险

该项目可以被出售到二级市场,例如主要通过合同交易来获得项目长期收益的信托基金、养老基金或资本金投资者。这些资产在运营阶段某些时候的出售对国家卫生部构成风险,因为潜在的新业主并不是当初签订原始合同的人。该项目的原始融资者之一Innisfree,现在是英国所有医院仅次于政府的第二大业主。这些公司目标的变更对医院也构成风险,因为其管理是基于市场力量而非健康福利。

1.12 Summary / 总结

Clearly PPP projects require detailed risk assessments. The length of concession and the uncertainties over long periods of time must be addressed prior tosanction. In PPP projects the private sector undertakes more risks than the public sector, therefore identifying, analysing and mitigating risks is paramount to the success of any project.

PPP项目显然需要进行详细的风险分析。在项目批准之前必须处理特许期长度和长时间的不确定性问题。在PPP项目中私营部门比公共部门承担更多的风险,因此,识别、分析和管理风险对任何项目的成功都是极为重要的。

In theUK,PFI/PPP has offered a solution to the problem of securing necessary investmentat a time of public expenditure restraint. According to UK government guidance, a PFI project should demonstrate considerable advantages over the Public Sector Comparator (PSC), thus the PSC should be used as a bench mark for establishing best value.

在英国,当公共开支受限时,PFI/PPP模式对获得必要的投资提供了解决方法。根据英国政府的指南,PFI项目应该证明有比公共部门比较因子(PSC)更为突出的优势,因此,公共部门比较因子应被用作基准以实现最大价值。

The Derant Valley Hospital project needed to create best value over a conventional approach. The project was delivered on time and to budget unlike many traditional public sector procurements,which often suffer from delay, cost overrun and compromise on initially planned requirements. One major requirement for a PFI project is the achievement of value for money (VFM). Therefore offering best value for money to the taxpayer was also a major financial objective of the Derant Valley Hospital project. The project’s actual cost was ?115 million, compared with the estimated ?250 million for the public finance option. The actual cost to the Trust of the building is approximately 4.5 times the initial CAPEX due to the long term repayment period, which is serviced through part of the unitary payment.

DerantValley医院项目需要超越传统模式而创造最大价值。该项目如期在预算内完成,而不像许多传统的公共部门采购项目那样经常出现工期延误、成本超支和未能实现原先计划的要求。对PFI项目的一个主要要求就是要实现“物有所值(VFM)”。因此,为纳税人提供最大的资金价值也是DerantValley医院项目的主要财务目标。该项目实际成本为1.15亿英镑,而采用政府融资方案则预计达2.5亿英镑。由于分期支付的长期性,其中部分是一次性支付,该项目对基金会的实际成本是最初资金成本的约4.5倍。

The National Audit Office, in 2001, estimated that the hospital would achieve valuefor money of ?5 million, and the hospital project could save the Trust between 4% and 14% over the life of the project. This however, is not the case. By virtue of being the first PFI hospital the NHS Trust had to accept a ?5 million per annum premium, based primarily on the uncertainty surrounding the long term operation. The hospital currently (2006 accounts) runs at a deficit of ?4million per annum.

国家审计署于2001年估计该医院项目可实现5百万英镑的价值,在项目全寿命周期内为基金会节约4%到14%的成本。然而事实上并非如此。由于该项目是英国第一个PFI医院项目,基金会不得不接受每年5百万英镑的额外费用,这主要是基于漫长运营期内的不确定性。该医院目前(2006年财务报告)每年亏损4百万英镑。

As well as value for money, a PFI solution also has to be in line with the wider government objectives, such as environment development and employment opportunities. Under the Derant Valley Hospital project, great emphasis was placed on shaping the built environment. The careand attention given to the design of a room and the quality of space, with respect to the integration of equipment and technology, has helped shape the environment, and takes into consideration the comfort of patients and users of the equipment and contributes more benefits to the environment.

除了物有所值,PFI方案还必须与更广泛的政府目标相一致,如环境的改善和就业机会的提供。在DerantValley医院项目中,则更强调建筑环境的改善。至于在设备和技术的结合上,关注和重视房间的设计和空间的质量,不仅有利于环境的改善,还考虑了病人和设备使用者的舒适,从而带来更大的环境效益。

For example, The Hospital Company employed solar control glazing and lowmaintenance building materials, such as aluminum roofing, to keep down longterm running costs, maximising the use of natural daylight for lighting and water cooling, and using off-site manufacturing for faster installation and improved quality control. This has been shown to help improve the well-being of patients and reduce the cost of care without reducing the standards specified.The private sector’s better utilisation of assets and increased operational savings from support service are a core requirement for the viability of most PPPs. In the case of Derant Valley Hospitalcosts of patient care and facilities management have increased to the extent that the hospital is running at an annual deficit.

例如,该医院项目公司应用了日光控制玻璃和较易维护建筑材料,如铝屋顶,以降低长期运营成本,最大化利用自然光来照明和水冷、采用场外制造技术以实现快速安装和改进质量控制。事实证明,这有利于改善病人健康状况和在不降低标准的同时降低护理成本。私营部门更有效的设施利用和配套服务运营成本的节余是大多数PPP项目可行的核心要求。在DerantValley医院项目中,病人护理成本和设施管理成本的增加已达到使医院亏损运营的程度。

1.13 Conclusions/ 结论

Derant Valley Hospital, was the first hospital to bebuilt and operated under the private finance initiative (PFI), and won the British Institute of Facilities Management award for PFI/PPP project of the year in 2001. Because of aninnovative funding approach and the efforts both of the Trust and The Hospital Company staff, the project aimed to achieve the Trust’s affordability target,and thus meet the UK Treasury’s value for money criteria.

Derant Valley医院是英国第一个采用PFI模式建设和运营的医院项目,并获得了2001年度“英国设施管理协会(BritishInstitute of Facilities Management)”大奖。由于创新的融资方式和基金会与医院项目公司员工的共同努力,该项目目的在于实现基金会的可负担目标,进而满足英国财政部的物有所值准则。

Under the Design-Build-Finance-Operate (DBFO) contract, the risks such asconstruction risks, residual risks, and operation risks were allocated to the consortium and have been, to date well managed by The Hospital Company (DareathLtd.). The experience and management skills of the private sector have been well utilised as the consortium is made up from Carillion Service Ltd. (serviceprovider) and Carillion Construction Company. The Carillion construction company handled the risks in the construction period and the project was delivered on time and to budget.

在设计-建造-融资-运营合同下,诸如建造、剩余和运营等风险分担给私营联合体,且至今获得医院项目公司(DareathLtd.)很好的管理。私营部门的经验和管理技能得到了很好的发挥,因为该联合体是由卡瑞林有限公司(服务提供商)和卡瑞林建设公司组成的。卡瑞林建设公司在建设阶段处理风险,并如期在预算内完工。

Experience in providing similar services, in this case high-quality service to NHS Trust and appropriate risk allocation and management which resulted in construction completion on time and to budget achieved value for money in that phase of the project. In the Derant Valley Hospital project, the benefits of PPP are successfully gained and the public objectives were also achieved but at a cost far exceeding the initial estimate.

提供类似服务的经验,在本案例中是为国家卫生部基金会提供高质量的服务和适当的风险分担及管理使得项目能够按时在预算内完成,并在建设阶段实现物有所值。在DerantValley医院项目中,PPP的好处得以成功地实现,公共部门的目标也得以实现,但成本大大超出原先的估计。

Criticism of this hospital, particularly the operation and maintenance element, was aired in a Channel 4 Dispatches programme on 14th August 2006. It stated that the long term O&M contract has allowed the Operator to imposes taggering charges for small day to day maintenance. Examples cited included changing a light bulb and hanging a mirror costing ?420 and ?200 respectively.The Clinical Director of Surgery condemned the charges saying: “You just know that when there is a middle man and a private company and there is a whopping charge for every trivial bit of maintenance that it is not value for money – it is blatantly obvious. All this money that has flooded into the Health Service,very little of it seems to have actually got through to patient care. There are extra staff and, luckily, extra doctors and nurses. But there are a lot of people with clipboards”. A Labour Party MP, went as far as saying the PFI/PPP, for this and many other hospitals is “a money making racket” and represent an enormous waste of money. An opposition party spokesman stated that the time has come for a fundamental reassessment of how the NHS access capital for their investment projects since PFI/PPP is becoming too unwieldy a tool for encouraging capital investment in the NHS.

2006年8月14日第4频道的Dispatches节目中提出了对该医院尤其是对运营和维护部分的批评。节目认为,长期的运营和维护合同允许运营者不断减少维护费用,例如更换420英镑的灯泡为200英镑的平面镜。外科医生主管也指责收费,说:“当有一个中间人和私营公司,通过每次微不足道的维护而收取昂贵的收费,你就知道这不是物有所值——这是非常明显的。所有流进服务公司的钱只有一小部分真正的用在了病人护理上。他们雇用多余的员工,幸好也有多余的医生和护士,但是仍然还有许多拿着纸夹板(不干实事)的人”。一个工党议员甚至说对本医院和许多其它医院而言,PFI/PPP是“赚钱机器”,浪费了大量的金钱。反对党的发言人声明,对国家卫生部如何为投资项目获得资金进行必要的再评估的时候到了,因为PFI/PPP已变为国家卫生部鼓励投资而滥用的工具了。

Clearly,this project has not met its financial objectives. Unitary payments are insufficient to meet the required level and the tax payer must subsidize this project by ?4 million per year. If this money cannot be found by the Trust then it is highly likely the hospital will scale down its operations and close sections of the facility. Sadly a number of UK hospitals procured as PFI/PPP projects are in the same situation. Currently the NHS has a deficit of ?500 million, despite spending ?70 billion on hospitals and services.

很明显,该项目没有达到其财务目标。一次性支付不足以满足所要求的水平,纳税人不得不每年补贴该项目4百万英镑。如果基金会不能找到这笔钱,那么很有可能医院就会按比例减少运营规模甚至关闭部分设施。不幸的是,英国许多采用PFI/PPP模式的医院都面临同样的问题。国家卫生部尽管在医院及其服务上支付了700亿英镑,但目前仍面临着5亿英镑的赤字。

When the hospital was first considered as a PFI/PPP project very little was done in terms of value for money compared to the value for money exercise a similar project would need to undergo in today’s market. A lack of clarity as to the long term operations phase, prior to sanction, shows that detailed assessments are required by both the public and private sector to ensure costs can be met without scaling down or reducing the performance specification.

当该医院第一次被考虑作为PFI/PPP项目时,很少有物有所值方面的考虑,相比之下,当今市场上同类项目必须进行物有所值评估。由于在批准之前,缺乏对长期运营阶段的清晰了解,表明公共部门和私营部门都必须进行详细的评估以保证成本可相抵而不会减少规模或降低绩效标准。

Sadly,at least ten major hospitals face closure, despite Government plans to spend a further ?1.5 billion on the Health Service over the next five years under the Private Finance Initiative. In some areas there are too many hospitals providing the same or similar services – which is not considered to be value for money. A misconception, however, is trying to compare the capital cost value and the full life cost value. Cost value relates to capital construction(CAPEX) whereas full life cost covers the cost, usually over a period of 30 years for feeding patients, cleaning and maintaining the building, therefore Government will need to pay the private companies ?58 billion over the next 30 years or so, although the actual CAPEX is ?8 billion.

不幸的是,至少有10个大医院面临关闭,尽管政府计划在下一个五年里采用PFI模式在医疗服务方面支出15亿英镑。在某些地区,有过多提供相同或类似服务的医院,他们也没有实现物有所值。然而,一个误解就是试图将资金成本价值和全寿命期成本价值进行对比。成本价值与建设资金相关,而全寿命成本包括所有的成本,通常包括在30多年里照顾病人、清洁和维护建筑物的费用。因此尽管实际的建设成本只有80亿英镑,政府将要在未来的30年支付给私营项目公司580亿英镑。

Finally,the Darent hospital, although operating at a greater cost than estimated was built on time and to budget, something not always common to projects procured by traditional methods.

最后,尽管Darent医院的运营成本比预期的高,但是能够按时在预算内完工,这在用传统方法采购的项目中是不常见的。

References / 参考文献

1. K&M (2004), Kent & Medway NHS web site,www.kentandmedway.nhs.uk

2. Carillion(2004), Carillion Group web site, www.carillionplc.com